A REPORT ON THE TREND AND PATTERN ON RESOURCE ALLOCATIONS BETWEEN STATE AND CENTRE IN THE POST REFORMS PERIOD

INTRODUCTION

Resource allocation means allocating available resources in different ways by proper planning or channel. In the context of government and country resource allocation means the distribution of tax revenues, managing different expenditures based on the need for the hours, and collection taxes from different sources by government. India is a country with federal in a structure which states that there is a division of powers as well as responsibilities between the union (central) and state governments. The financial structure of India is also federal in nature. Even the constitution of India has also strictly talked about decentralizing the revenues and expenditure on both the levels of government i.e. the central and the states. Thus, in order to combat any kind of fiscal imbalances either between the union and state governments or among the states, the president of India has established the Finance commission in 1951 under article 280 of the constitutions and made it compulsory that each and every finance commissions will have to make a recommendation about the net proceeds of taxes distribution between the union and the states i.e. vertical devolution or among states i.e. horizontal devolution.

The Commission consists of one chairman including four other members and is appointed every five years. Up until now the total of 15 finance commissions has been formed since 1951. In addition, the Finance commissions also play a role in recommending the provision of additional grant-in-aid to the states by the Union government if it is required.

In India, the major source to finance the government expenditures is done through revenue obtained mainly from the collection of taxes by both the governments. The Centre has the majority of power in order to decide about taxes which are buoyant and broad-based such as corporation tax, excise taxes and income taxes whereas the states have the powers in deciding taxes about stamp duties, entertainment taxes, and sales tax. Now talking about expenditure decentralization part of resource allocation the Union government has been entitled to look after the areas of national interests money and banking, foreign trade, foreign exchange management, and defence while the states have been entrusted with responsibilities to facilitate industry and agriculture, public and state infrastructures such as roads, and provisioning of social services like schools, hospitals etc. while there are certain things included in the concurrent list which are shared by both states and central governments.

This study includes five sections. In Section I, there is a discussion about different sources of tax or non-tax revenue of states and Union governments, as per the following sources included in the three lists i.e. union list, state list, and concurrent list. Section II will discuss the trends and changing patterns in vertical devolution of resources (between union and state) in the post-reform period. Section III will describe the trends and pattern of horizontal devolution of resources (among the states) in the post-reform period. Sections IV will shed some light on changing trends in devolution and will give some analysis about the factors which are affecting both the vertical and horizontal devolutions. At last, Section V will give a conclusion about the whole study.

SECTION-I

SOURCES OF REVENUE (STATES AND UNION)

As taxes are the major sources of revenue for financing expenditure, it is necessary to know about the kind of taxes Union and states government impose to raise revenue. However, both the level of government also raise revenue from some non-tax sources. From Article 264 to Article 300 i.e. Part XII of the constitution dictates financial provision. The division of functions as well as financial resources between the centre and the states has been done in accordance with the Seventh Schedule of the constitution and the schedule contains three lists such as Union list, State list and Concurrent list.

These lists have clearly separated the Union and State governments power to raise revenue from which sources. The Union list has a total of 97 subjects which will be looked after by Centre, the State list has 66 subjects which are a matter of concern for State, and the Concurrent list has matters which cannot exclusively look after by solely either by Union or States such as economic planning, criminal law and procedure, books, printing press etc.

Now based on the above three lists we will see the sources of revenue (either tax or non-tax) of both the levels of government.

List 1: Union list

Given the following chart 1 has discussed the tax and non-tax revenue sources of

central government:

List 2: state list

This list of seventh schedule of constitution contains 66 entities and incorporates information about functioning and financial resources of state government. The given chart 2 has pointed out the tax as well as non-tax revenue sources of state government:

Coming to the Concurrent list there is no such sources for revenue provision, made in constitution which will come jointly under both the level of government i.e. the state and Union.

SECTION II

TRENDS AND CHANGING PATTERN IN VERTICAL DEVOLUTION (POST-REFORM PERIOD)

Vertical devolution means the distribution of net proceeds of taxes of central government between the Union and the states. We will begin here in the centre and states revenue shares. Looking at the trend of the tax-GDP ratio of India for the period (1991-2019) i.e. post-reform period, it has fluctuated in between interval of 14-15% for 25 years till 2004-05. And thereafter it rose slowly to 17.8% and 18.2% for 2014-15 and 2018-19 respectively. As the tax-GDP ratios were stagnant with low levels for several decades signifies that in India state and Union governments have limited fiscal space.

The Centre collected about 60% of the total revenue which rose to 68% in 2007-08 but again dropped by 3% i.e. 65% in 2018-19. Looking to the statistics of combined tax revenue of both the governments, states’ own tax share remained in between 30-35% till the early 1990s but after the reform, it rose to 39% in 2014-15 but again came down to 35% in 2018-19. So,

it was the period from 2007-2014 that the states make great effort to raise their own tax share. In recent time, the tax revenue of Union has increased from 10% of GDP (2014-15) to 11.8% of GDP (2018-19) while that of States’ own tax revenue has reduced by 0.5% to 6.4% for the same interval. Of its total tax revenue collected, the Union government passes a substantial portion to the states according to the recommendation of Finance commissions. The states’ share in Union taxes had fluctuated between 26% and 29% till 2014-15 but boosted up to

34-37% in recent time. We see trend of states’ share in given below following figure:

FIGURE 1: SHARE OF STATES’ IN UNION TAX

Source: Indian public finance statistics

In order to decide the extent of devolution, the Finance commissions have not only considered the trends of taxes but also to the tax buoyancy of both the level of governments i.e. the Union and states. It is not the case that either only the Union or the states were having buoyant taxes throughout the time. The Centre taxes were more

buoyant for periods 1995-2000, 2005-10 and 2015-18 whereas the States’ taxes were more buoyant for period 2000-2005 and 2010-15 (figure 2).

Another point to be noted is that as the GST got introduced in 2017, now both the centre and states are now sharing common tax base especially for indirect taxes and thus considering GST revenue, it is likely to grow at the same rate for both the level of governments.

FIGURE 2: TAX REVENENUE BUOYANCY OF CENTRE AND STATES

Source: Institute of Economic Growth

As above we have seen revenue share of both the governments, there is now need to discuss about revenue expenditure or their expenditure share. On an average basis revenue expenditure of the states; have always been higher than that of Union. The states’ share in combined revenue expenditure were in between 56-60% from 9th Finance commission to 14th whereas that of centre’s varied between 40-44. The share of the states and centre in combined revenue expenditure in post reform period can be visualised in detail from the given below table 1 and trend line given in figure 3:

TABLE 1: CENTRE AND STATES SHARE IN COMBINED (%)

Source: Handbook of statistics on Indian economy, RBI

FIGURE 3: EXPENDITURE ON COMBINED BASIS

From the above table 1 and trend line, we can see that for the last decade centre’s share in combined revenue expenditure has reduced by 8% i.e. from 47.1% (2005-10) to 37.2% (2015-18) while there has been a significant increment in states’ share i.e. 52.9% to 61.8% for the same period. These figures clearly pointed out that in recent years change in the balance of revenue expenditure has been mainly in favour of state government.

Now considering the revenue gap which is defined as revenue expenditure is more than that of revenue generated. So, in case of revenue gap of states, it will be defined as states’ revenue expenditure fewer states’ own generated tax revenue. It was estimated to be in the range of 6 & 7.5 % of GDP for 1988-2005, then reduced to below 6% for 2005-2014 and again shoot up to 8% in 2017-18 and 2018-19. This increment in recent years is mainly due to the fact that the revenue expenditure of states has increased to 14% while its own tax revenue remained at 6%.

The Finance commission recommendation for the tax-devolution has quite fairly helped states to fill their revenue gap as for the periods of 9th FC to 11th FC the states were able to fill up the revenue gap by 33%-38% with the help of tax devolution. The extent of tax devolution to bridge the revenue gap rose sharply to 52% for the first 4 years of 14th FC. Detailed information about tax devolution and the revenue gap in the post-reform period has been given in table 2:

TABLE 2: TAX DEVOLUTION AS % OF GDP AND REVENUE GAP

Source: Indian Public Finance Statistics and Economic survey 2018-19

State-wise share in Divisible Pool of Union taxes is as follow:

SECTION III

HORIZONTAL FISCAL DEVOLUTION: TRENDS AND PATTERNS (POST REFORM PERIOD)

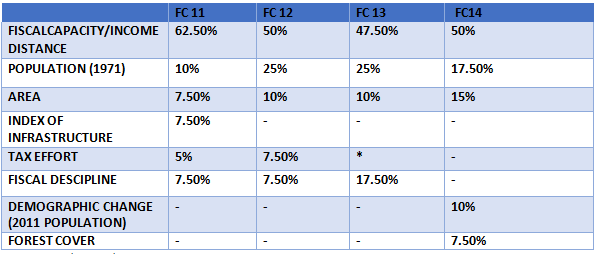

Horizontal devolution means distribution or devolution of the resources among states. The states’ population is the major factor in determining the share of states in total resources available for resources. However, assignment of weights to population differ from one commission to another. Irrespective of population, there are also several factors such as area, infrastructure, tax effort, the backwardness of the states which determine the share of states. The following table 3 given bellow provides the criteria as well as weights for the FCs 11th to 14th:

TABLE 3: COMPONENTS OF HORIZONTAL DEVOLUTION WEIGHTS AND FORMULA (11th to 14th FCs)

Source: 11th to 14th Finance Commissions report

Since 8th FC the tax capacity of the state or income is the major criteria which account for more than 50% of the sharable tax revenues to be distributed among states. Considering the 2011 population as base the 14th Finance commission has assigned it the weight of 10%. On the basis of cost disability indicators, weight to the area increased by 5% for 14th FC as compared to last to FCs. After giving the weight of 7.50% for 11th FC, 12th FC found out that the infrastructure criteria seemed correlated with income distance and so concluded that it will be better to treat it in an ordinary way and hence eliminated this from them.

It was for the first time during 14th Finance commission found that forest and its positive externalities influence both the expenditure needs as well as revenue capacities of the state and provides huge ecological benefits to the state but it also has an opportunity cost for areas under forest not available for other economic activities. Keeping in mind all these things 14th FC assigned weight of 7.5% to forest cover. The 13th Finance commission increased the weight of fiscal discipline from 7.50% to 17.5% as it was supposed that the criteria will incentivize the states to follow fiscal prudence, especially in relation to fiscal correction but 14th Finance commission though it as an extra burden on the back of states with revenue deficits and so the criteria were dropped for the 14th FC.

SECTION IV

ANALYSIS: FACTORS AFFECTING BOTH VERTICAL AND HORIZONTAL DEVOLUTION

Factors such as budgetary as well as equity policy of the central government affect these vertical and horizontal devolution of resource because the government has to forgo some of the efficiency-based indicators of resource allocations to achieve equity policy. In India, transfer of resources from centre to states has been classified as general grants and specific purpose grants. General-purpose, as well as some specific purpose grants, were distributed on the recommendations of FCs while the majority of the specific purpose grants were given on the plan made by Planning Commission. But after the abrogation of Planning Commission (august, 2014), most of the grants are now made in accordance with FCs.

To compensate plan expenditure grants which were foregone and making states more flexibility in resource allocation through grants which were untied, the 14th FC increase states’ share by 42% in the divisible pool of resources. The 14th FC recommended to increase the states’ share in centre tax revenue by 10% i.e. 42% from 32 % (13th FC) and was thus expected to have its consequences for both centres and states in their spending on the social sector. Though the centre accepted this proposal, they reduce their own spending on the social sector through a transfer for specific grants.

In India, it is really going to be one of the major challenges for coming to FCs to decide what to choose in between tax devolution and grants in aid for transferring the centre’s resources to states. The previous FCs have considered five areas i.e. relief for disaster, revenue deficit, sector as well as states’ specific schemes, local bodies as areas for grant in aid for states.

However, these grants overlap with plan grants of the centre to states and have raised several concerns. Any changes in this will affect the vertical and horizontal devolutions. Considering these, the 14th finance commission notes that it is not so necessary to grants for both sectors as well as state-specific schemes and to compensate the states’ share in centre’s tax revenue was increased to 42% from 32%. It was expected from this proposal to provide state more leveraged in planning their spending depending on needs in specific sectors.

Given below table no 4 gives information about 14th FC recommendation about grants in aid (different states):

TABLE 4: GRANTS-IN-AID TO STATES (14th FC)

Source: Report of 14th FC, Government of India

Introduction of goods and service tax (GST) which is supposed to be one of the major reforms in case of commodity tax in India. This very reform has implications for centre and states’ collection of tax revenue and thus may it will also affect the pattern of vertical and horizontal devolution of resources. The 14th FC considered this problem but was not able to do an assessment of both the level of governments as the GST was not implemented at that

time. Now it is really challenging for 15th FC as they do have to assess and recommend the changes GST will bring and have also to deal with the fiscal imbalance of states as well as centre it has caused. It is expected to have a positive impact of GST increasing centre and states’ revenue may because of increase in transparency and tax base or reduction in tax evasion in long run but in short-run, the revenue of states will reduce. GST being the destination-based tax may be a worry for industrialised states such as Tamil Nadu, Maharashtra, Gujarat etc. as goods produced here are consumed elsewhere which yield tax revenue to jurisdictions in which they are purchase and consumed.

SECTION V

CONCLUSION

In order to maintain the federal structure of India, Finance commissions have played a very vital role by making so many recommendations. By analysing the pattern and trends of resource allocation between states and Union in India, it has been found that over the year allocation has been mainly in favour of states. In India, the resources are distributed as vertical devolution (between states and Union) and horizontal devolution (among the states). For the case of vertical Devolution, it has been pointed out that in recent time the tax revenue of Union has increased from 10% of GDP (2014-15) to 11.8% of GDP (2018-19) while that of States’ own tax revenue has reduced by 0.5% to 6.4% for the same interval.

In case of horizontal devolution, it has been seen that the 14th Finance commission has given certain importance to forest cover by justifying that the forest cover influences both the expenditure needs as well as revenue capacities of the state and provides huge ecological benefits and assigned it the weight of 7.5 %. This has not been considered in the earlier Finance commission. It has also been the first time that the 14th finance commission gave some weight to the population of 2001 as an indicator to distribute resources among states.

One of the major factors which are supposed to be a prominent factor in changing pattern and trends of resource allocation is the GST. In the short run, it is supposed to reduce the revenue of states but in the long run, its impact could be positive for both states and union as it is more transparent will cause to reduce tax evasion and thus to increase the tax base.

Download the full document here

Author: Anuradha M.A. Economics Central University of South Bihar

REFERENCES

https://en.wikipedia.org/wiki/Fourteenth_Finance_Commission https://www.epw.in/fourteenth-finance-commission

Chakraborty, P. (2010). Deficit Fundamentalism vs Fiscal Federalism: Implications of 13th

Finance Commission’s Recommendations. Economic and Political Weekly. 56- 63.

Bhaskar, V. (2015). Stance on Devolution and Grants. Economic and Political Weekly. 50(21),36-40.

Draft Report, The Fifteenth Finance Commission Of India (2019), ” Resource Sharing Between Centre And State And Allocation Across States: Some Issues In Balancing Equity And Efficiency”, Institute Of Economic Growth, Delhi.